Translation and analysis of words by ChatGPT artificial intelligence

On this page you can get a detailed analysis of a word or phrase, produced by the best artificial intelligence technology to date:

- how the word is used

- frequency of use

- it is used more often in oral or written speech

- word translation options

- usage examples (several phrases with translation)

- etymology

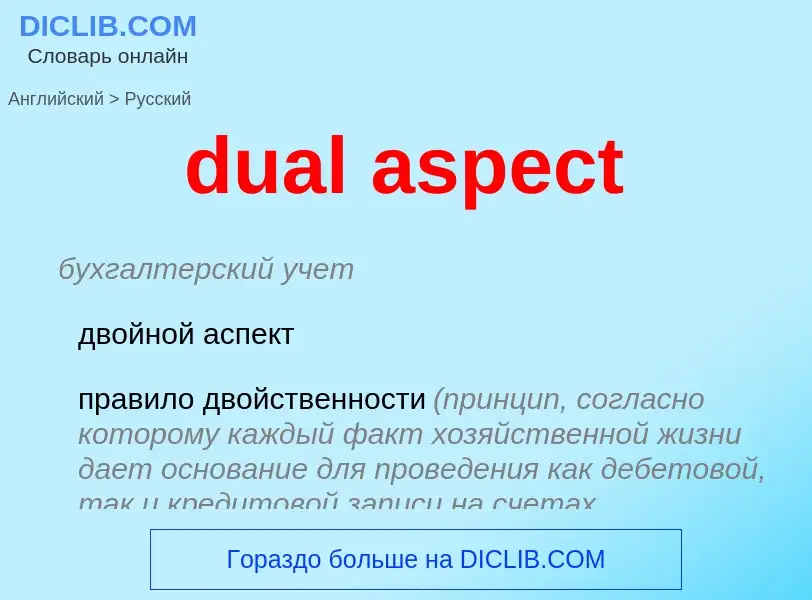

dual aspect - translation to russian

бухгалтерский учет

двойной аспект

правило двойственности (принцип, согласно которому каждый факт хозяйственной жизни дает основание для проведения как дебетовой, так и кредитовой записи на счетах бухгалтерского учета)

математика

двойственное пространство

математика

двойственное расслоение

Definition

Wikipedia

Double-entry bookkeeping, also known as double-entry accounting, is a method of bookkeeping that relies on a two-sided accounting entry to maintain financial information. Every entry to an account requires a corresponding and opposite entry to a different account. The double-entry system has two equal and corresponding sides known as debit and credit. A transaction in double-entry bookkeeping always affects at least two accounts, always includes at least one debit and one credit, and always has total debits and total credits that are equal. The purpose of double-entry bookkeeping is to allow the detection of financial errors and fraud.

For example, if a business takes out a bank loan for $10,000, recording the transaction would require a debit of $10,000 to an asset account called "Cash", as well as a credit of $10,000 to a liability account called "Loan Payable".

The basic entry to record this transaction in a general ledger will look like this:

Double-entry bookkeeping is based on balancing the accounting equation. The accounting equation serves as an error detection tool; if at any point the sum of debits for all accounts does not equal the corresponding sum of credits for all accounts, an error has occurred. However, satisfying the equation does not guarantee a lack of errors; the ledger may still "balance" even if the wrong ledger accounts have been debited or credited.

![''Della mercatura e del mercante perfetto'' by [[Benedetto Cotrugli]], cover of 1602 edition; originally written in 1458 ''Della mercatura e del mercante perfetto'' by [[Benedetto Cotrugli]], cover of 1602 edition; originally written in 1458](https://commons.wikimedia.org/wiki/Special:FilePath/Cotrugli - Della mercatura, 1602 - 122.jpg?width=200)